For numerous foreign investors, the United States stands as a land of immense opportunity, a destination for creating tomorrow, and a secure setting for their families. Yet, the path to permanent residency typically seems like maneuvering through a challenging landscape. This is where the EB-5 Immigrant Investor Program enters the picture, serving as a reliable compass for those seeking to make a meaningful investment in the U.S. economy in exchange for the prestigious copyright. If you are an investor investigating your options for U.S. immigration, this comprehensive guide is created to answer your questions and illuminate the journey ahead. We will delve into the specifics of the program, from the starting investment to the final steps of securing permanent residency, using the framework provided by U.S. Citizenship and Immigration Services (USCIS) to provide you with the most accurate and reliable information readily available.

Main Insights

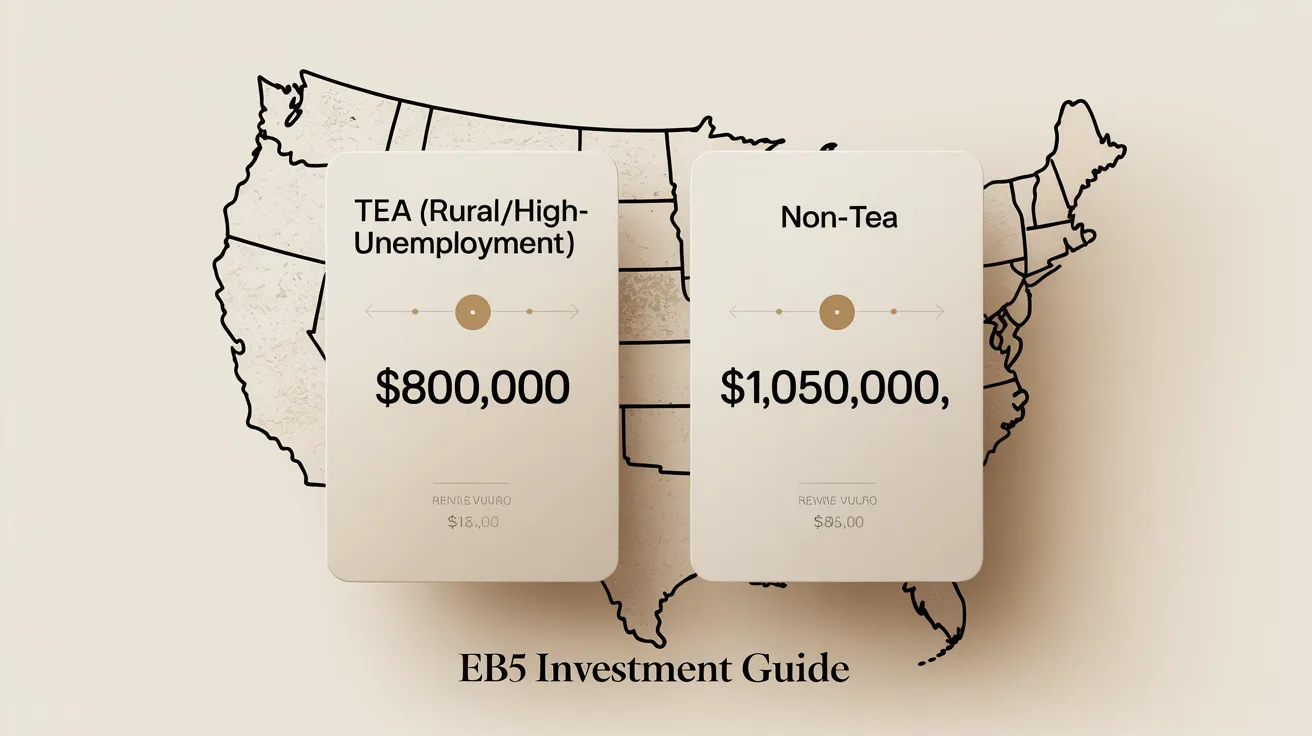

- The EB-5 visa program offers a reliable path to obtaining a U.S. copyright through investment, necessitating a capital commitment of $800,000 in designated TEA locations or $1,050,000 in non-TEA locations.

- The procedure requires filing Form I-526/I-526E, obtaining a two-year Conditional copyright, and afterward completing Form I-829 to remove the conditional status.

- Investors can select from a managed investment option through a Regional Center or a active personal investment method.

- Thorough documentation of the proper financial documentation is an essential element that strongly influences favorable application results.

- Individuals applying from heavily impacted regions may face processing delays and should keep an eye on the Visa Bulletin for priority date movement.

- The program offers copyright status for qualified investors and their family members, with a possible route to U.S. citizenship after 5 years of residency.

The Ultimate Guide to the Investment-Based EB-5 Visa

This EB-5 copyright by investment is more than just a visa; it is a golden ticket to a new life in the United States. Overseen by USCIS, this program was created to stimulate the U.S. economy through job creation and capital investment by foreign investors. In exchange for their contribution, investors, along with their spouses and unmarried children under 21, can acquire a copyright, offering them the freedom to live, work, and study anywhere in the country. This pathway ranks among the most trustworthy routes to permanent residency, as it doesn't need sponsorship from an employer or a family click here member, delivering a level of independence that is particularly appealing to international investors and entrepreneurs.

The EB-5 investment program represents a testament to America's commitment to foreign investment driving economic growth. In contrast to other immigration options that depend on family connections or employment sponsorship, the EB-5 route allows investors to take control of their immigration destiny through strategic investment placement. This autonomous approach resonates with successful business professionals and entrepreneurs who opt to utilize their own financial resources rather than external sponsors.

Capital Foundations: The EB-5 Investment Amount Demystified

At the foundation of the EB-5 program exists the investment itself. The mandatory capital contribution isn't a one-size-fits-all figure; it varies based on the geographical area of the project in which you invest. Grasping these financial requirements serves as the fundamental and crucial phase in your EB-5 path. USCIS has established two different investment levels that represent the economic development priorities of the United States administration.

Examining the Two Levels: $800,000 vs. $1,050,000

A potential investor has to contribute a minimum of $800,000 for investments in ventures established in a Targeted Employment Area (TEA). On the other hand, the required investment jumps to $1,050,000 for projects not within these special regions. These figures are deliberately set; they are strategically determined to guide capital into areas that need it most, and the variance is substantial enough to make the project location a crucial strategic element.

The investment criteria were determined with specific purpose to guide foreign capital into economically underserved regions. The $250,000 variance between TEA and non-TEA investments represents a considerable incentive that can impact investment choices and broader investment planning. Investors need to thoroughly assess not only the monetary aspects but also the lasting sustainability and workforce development opportunities of projects in diverse regional zones.

Location, Location, Location: The Strategic Importance of a Targeted Employment Area (TEA)

The concept of a Targeted Employment Area (TEA) is a cornerstone of the EB-5 program. A TEA is defined as either a rural area or an area experiencing high unemployment, namely areas with unemployment rates of at least 150% of the national average. The decreased investment threshold of $800,000 for projects within TEAs is a powerful incentive aimed at direct foreign capital into communities that stand to gain the most from economic development and job creation.

For investors considering a TEA-based project, there's more than just minimizing the capital outlay; these investments can also provide benefits including faster processing times and robust possibilities for meeting the program's strict job-creation criteria. Selecting a project within a TEA can thus become a pivotal decision that determines the entire trajectory of your EB-5 visa copyright application. Because TEA designations are carefully monitored and updated periodically, it's vital for investors to validate present designation prior to committing to any project.

Launching Your American Dream: The I-526/I-526E Form Process

After identifying your investment project, the official process for your EB-5 copyright begins with submitting Form I-526E for Regional Center investments, or Form I-526. This submission to USCIS has to clearly establish that your investment meets all necessary qualifications. This encompasses not only providing the mandatory investment funds but also providing a comprehensive strategy outlining how the investment will create a minimum of 10 full-time jobs for qualified U.S. employees.

The I-526/I-526E petition acts as the basis of your complete EB-5 case. All future stages in the process relies upon the strength and completeness of this initial petition. The application must present a compelling business case that establishes not only adherence to program requirements but also the feasibility and longevity of the proposed job creation. USCIS adjudicators examine these petitions with considerable attention to detail, making thorough preparation absolutely essential.

Source of Funds Verification: Establishing Your Legitimacy

A vital part of the I-526/I-526E petition is the documentation of the legal source of your investment funds. USCIS emphasizes heavy weight on this part of the application, and you will need to present a meticulous and traceable accounting of the derivation of your capital. This requires providing extensive financial records, namely bank statements, tax returns, and verification of property sales or other transactions, to establish a definitive and complete chain of proof that your funds were gained through proper means.

The thoroughness of your source of funds documentation greatly influences the success of your petition. USCIS requires complete traceability of funds from where they originated through all transfers leading to the EB-5 investment. This documentation needs to cover currency conversions, transitional transfers, and all borrowing or gifting involved in building the investment amount. The intricacy of this process often necessitates partnering with qualified specialists who comprehend the precise documentation requirements required by USCIS.

The Investment Journey: Choosing Between Investing in a Regional Center and Direct Investment

The established EB-5 immigrant investor program offers two unique options for investors: investing through a USCIS-approved Regional Center or pursuing a direct investment into a new commercial enterprise. The choice between these two models will depend on your personal goals, your desired level of involvement, and your comfort with risk. Each route comes with unique benefits and considerations that need to be carefully considered in the context of your particular situation and goals.

A Regional Center operates as an economic unit, public or private, that focuses on advancing economic expansion. Regional Centers have gained popularity as they allow more hands-off investment opportunities, combining capital from various investors and administering the investments for them. They also feature more adaptable job creation calculations, permitting the inclusion of indirect and induced jobs alongside direct employment. This broader job creation approach can make it easier to satisfy the program's employment criteria.

Making a direct investment, conversely, requires a higher degree of participation, where the investor directly participates in the management of the business. This approach offers enhanced control but also calls for a higher level of management involvement. Direct investments have to prove job creation through exclusively direct hiring, which can be harder to achieve but also more clear and demonstrable. The decision between these pathways should match your investment philosophy, available time for involvement, and comfort level with varying business risk factors.

Navigating the Two-Year Conditional copyright Period

Upon approval of your Form I-526/I-526E petition and when a visa is available according to the Visa Bulletin, you and your eligible family members will be granted a Conditional copyright, which remains valid for two years. This marks a major milestone, allowing you to reside in the U.S. and start your new life. Nevertheless, as the name indicates, this status is conditional and includes specific responsibilities that must be fulfilled to keep your legal status.

During this two-year duration, your investment capital must continue to be fully invested and at risk in the project, and the venture must continue towards satisfying the job creation requirements. This timeframe acts as a testing period, where you must demonstrate your continued commitment to the terms of the EB-5 program. The temporary character of this position means that not meeting program requirements can result in the loss of your copyright and possible removal from the United States.

Being a conditional resident offers many of the same privileges of permanent residency, such as the right to work, travel, and access certain government services. Nevertheless, the conditional status creates ongoing compliance obligations that require diligent tracking and record-keeping. Investors must maintain thorough records of their investment's performance, employment generation status, and adherence to residency guidelines during the conditional term.

Removing Conditional Status: Understanding Form I-829

To convert from a conditional resident to a copyright, you need to file Form I-829, the Petition by Investor to Remove Conditions on copyright Status. This petition must be filed in the 90-day period prior to the second anniversary of your entry to the U.S. as a conditional resident. The I-829 petition serves as the final step in demonstrating that you have met all the requirements of the EB-5 program.

You must submit documentation that your investment continued throughout the conditional residency period and that the specified 10 full-time jobs for U.S. workers were created or maintained due to your investment. After approving your I-829 petition, the conditions on your copyright will be lifted, and you will receive copyright status. This marks the completion of your EB-5 journey and the fulfillment of your objective of acquiring permanent U.S. residency through investment.

The I-829 submission needs thorough paperwork proving conformity to every program requirement throughout the conditional residency. This consists of financial documentation demonstrating sustained investment, employment documentation validating job creation, and proof of the investor's continued involvement in the business. The comprehensiveness and precision of this documentation directly impacts the likelihood of petition approval and the favorable lifting of temporary status.

Patience is a Virtue: Understanding Backlogs, the Visa Bulletin, and Your Priority Date

For individuals from countries heavily pursuing EB-5 visas, including China, India, and Vietnam, the journey to securing an investment copyright USA can entail a considerable waiting period. This is attributed to the annual per-country visa limits established by the U.S. Congress, which cap the number of visas that can be issued to nationals of any single country at 7% of the total annual allotment for each visa category.

When you file your I-526 petition, you are given a "Priority Date," which basically indicates your spot in the waiting list. The Visa Bulletin, published each month by the U.S. Department of State, offers information on visa allocation and monitors the movement of priority dates for respective country. You will need to review the Visa Bulletin to track the movement of priority dates and to learn when a visa becomes ready for your case.

As the traditional wisdom tells us, "patience is a virtue," and this is particularly relevant for EB-5 investors from oversubscribed countries. It is crucial to incorporate these potential waiting times into your long-term planning and to recognize that the immigration process might span several years from initiation to completion. An experienced EB-5 visa attorney can offer essential assistance in handling these intricacies and creating strategies to navigate the waiting period successfully.

Opening Doors to Success: The Key Benefits and Opportunities in the EB-5 Program

Regardless of the strict prerequisites and anticipated waiting periods, the EB-5 program delivers multiple benefits that establish it as a popular immigration avenue. The key benefit is the chance for the investor, their spouse, and their unmarried children under 21 to acquire permanent residency in the United States. This presents endless options, including the right to reside, work, and pursue education across in the country without the need for a sponsor.

The EB-5 pathway delivers unmatched versatility in contrast with other immigration routes. Unlike employment-based visas that tie you to a specific workplace or area, the EB-5 copyright allows total geographic and professional mobility. You have the ability to establish a company, transition careers, or seek academic opportunities without immigration constraints. This liberty is especially valuable for entrepreneurs and business professionals who appreciate independence and flexibility in their professional decisions.

What's more, after keeping permanent residency for five years, EB-5 investors and their loved ones can become eligible to apply for U.S. citizenship, completing their path from investor to American citizen. The path to citizenship through EB-5 is uncomplicated, calling for only the continuation of copyright status and compliance with standard naturalization requirements. This symbolizes the final realization of the American dream for numerous international investors and their loved ones.

Common Queries

What you need to know about the EB-5 copyright process?

The path to obtaining an EB-5 copyright is a multi-step journey for foreign investors to secure copyright status in the United States. The process starts with choosing a qualifying EB-5 project, through either direct investment or Regional Center participation. Investors must submit Form I-526 or I-526E with USCIS, furnishing extensive documentation of their investment and the lawful source of their funds. Following petition approval and when visas become available, the investor and their family receive a Conditional copyright valid for two years. In this timeframe, investors must maintain their investment and create at least 10 U.S. jobs. Ultimately, investors submit Form I-829 to lift the conditions of copyright and obtain unrestricted copyright.

How much investment is needed for EB-5?

The baseline investment threshold for the EB-5 program is set at $800,000 for projects situated within a Targeted Employment Area (TEA). A TEA refers to either a high-unemployment region or rural territory. For projects not within a TEA, the investment threshold is $1,050,000. These amounts are set by USCIS and are a critical factor in an investor's decision-making process. The investment has to be maintained at risk throughout the conditional residency period and must be sourced from lawful means with full documentation.

How do we define a Targeted Employment Area (TEA)?

A TEA designation refers to a geographic location recognized by USCIS that meets the criteria of either a rural location or an area with an unemployment rate of at least 150% of the national average. The primary purpose of this designation is to encourage investment in areas of the country that require additional capital. Funding a TEA-based project permits a potential investor to become eligible for the lower investment requirement of $800,000. TEA designations are determined on particular economic and geographic criteria and are modified regularly to incorporate changing economic conditions.

What are the key differences between Regional Center and direct investments?

When considering EB-5 investment, individuals can select from two investment models: Regional Center investment or direct investment approach. A Regional Center is a USCIS-approved entity that manages investment projects and pools capital from multiple investors. This is a more passive investment option, as the Regional Center manages the day-to-day management and job creation requirements. Regional Centers are able to include indirect and induced jobs toward the employment requirement. A direct investment involves greater personal involvement where the investor is actively involved in the company administration. This option gives more oversight but necessitates more operational responsibility from the investor and must solely rely on direct jobs toward the employment requirement.

Understanding Conditional copyright

The Conditional copyright serves as a temporary, 24-month copyright granted to EB-5 investors upon the approval of their I-526 petition and visa allocation. It enables the investor and their dependents to live and work in the U.S. Still, the status stays provisional upon the investor meeting all EB-5 program requirements, including sustaining their investment and creating the required number of jobs. To transition to permanent residency, the investor is required to file Form I-829 ahead of the end of the two-year term. Failure to file on time or fulfill program requirements may lead to status termination and expulsion from the United States.